Planning for retirement is one of the most important financial goals anyone can set. The challenge lies in figuring out where your income will come from once you stop working. This is where understanding what are pensions and annuities becomes essential. Both are designed to provide steady income, but they work differently, and knowing the distinction can greatly influence your retirement security.

Many people confuse pensions with annuities or even use the terms interchangeably. However, pensions are typically employer-sponsored retirement plans, while annuities are personal contracts purchased from insurance companies. By gaining clarity on what are pensions and annuities, you can make smarter choices about how to use them together or separately to build a stable financial future.

What Are Pensions and Annuities

A pension is essentially a promise from an employer to provide retirement income. Employees and employers contribute to a pension fund over time, and once the employee retires, they receive regular payments. These payments are usually based on salary history and years of service, making pensions predictable and reliable.

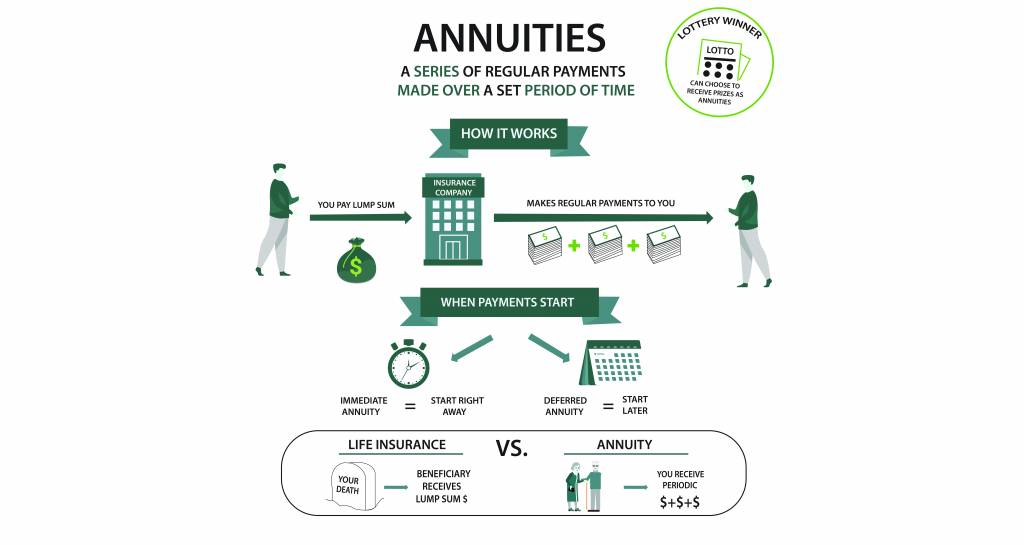

An annuity, in contrast, is an agreement with an insurance company where you pay a lump sum or regular premiums. In exchange, the company pays you a fixed income stream over a specified period or for life. When exploring what are pensions and annuities, the difference is clear: pensions are employer-managed benefits, while annuities are purchased by individuals to secure extra income.

How Pensions Work

Pensions are often described as defined benefit plans because they guarantee a specific payout based on a formula. This formula usually considers your salary, years of service, and sometimes age at retirement. For example, an employee who spends decades with the same company may receive a larger pension than someone with a shorter tenure. This makes pensions especially valuable for long-term employees.

Another important aspect of pensions is that they are funded by both employers and employees. Contributions are pooled into a pension fund that grows over time through investments. At retirement, the employee begins receiving payments. When people ask what are pensions and annuities, pensions stand out because they offer security that is tied to employer stability rather than individual investment decisions.

How Annuities Work

Annuities operate differently because they are purchased directly by individuals. You can use your pension savings, personal savings, or retirement accounts to buy an annuity. Once purchased, the insurance company takes responsibility for providing you with regular income. Depending on the type of annuity, payments can start immediately or be deferred until later in retirement.

There are many types of annuities, such as fixed, variable, and indexed. A fixed annuity guarantees the same payment every period, while a variable annuity depends on market performance. Indexed annuities link returns to a stock index but still provide a minimum guaranteed payout. This flexibility makes annuities attractive for those seeking control over their retirement income strategy. Understanding what are pensions and annuities helps you see how annuities can complement or replace pensions.

Pensions and Annuities Key Differences

The most significant difference lies in the source of income. Pensions come from employers as part of a retirement package, while annuities are purchased independently. This means pensions are tied to your job, while annuities give you freedom to create income regardless of employment. For many, this distinction answers the question of what are pensions and annuities in practical terms.

Another difference is ownership and control. With pensions, your employer manages contributions and payouts, so your influence is limited. Annuities, however, allow you to choose terms such as payment schedules, duration, and whether payments continue to beneficiaries after death. By understanding these key differences, retirees can better balance the stability of pensions with the flexibility of annuities.

Tax Rules for Pensions and Annuities

Taxes play a major role in retirement planning, and both pensions and annuities are usually taxable. The IRS general rule for pensions and annuities states that most payments are taxed as ordinary income. This means you need to include them on your annual tax return, specifically on Form 1040 pensions and annuities sections.

There are also special rules like the simplified method for pensions and annuities, which helps calculate the taxable amount when part of your contributions were made with after-tax dollars. It is essential to understand the taxable amount of pensions and annuities so you can plan your withdrawals wisely. When asking what are pensions and annuities, it is equally important to ask how they will affect your tax bill in retirement.

Choosing Between Pensions and Annuities

The decision between pensions and annuities often depends on your circumstances. If you are fortunate enough to have a pension, you already have a reliable source of income. However, adding an annuity can enhance your financial security by creating another guaranteed income stream, especially if your pension does not fully cover your living expenses.

For those without employer pensions, annuities provide a valuable alternative. They can turn retirement savings into predictable income and reduce the risk of outliving your money. Financial planners often recommend a mix of both when possible. When considering what are pensions and annuities, the real question becomes how you can use them together to design a retirement strategy that works for your lifestyle and goals.

Conclusion

Pensions and annuities are both powerful tools for building retirement security, but they serve different roles. Understanding what are pensions and annuities helps you recognize that pensions are employer-funded promises, while annuities are individual contracts that you buy to ensure steady income.

The key takeaway is that pensions provide stability tied to your career, while annuities offer flexibility and personal control. By combining both wisely and understanding their tax rules, you can create a retirement plan that not only meets your financial needs but also gives you peace of mind for the future.

FAQs About Pensions and Annuities

What are pensions and annuities in simple terms?

Pensions are employer-sponsored retirement plans, while annuities are purchased contracts that guarantee income.

Are pensions and annuities taxable?

Yes, most pension and annuity payments are taxable as ordinary income.

How do I report pensions and annuities on Form 1040?

They are reported in the income section of your federal tax return, showing both the total and taxable amounts.

What is the IRS general rule for pensions and annuities?

It states that most payments are fully taxable unless you contributed after-tax dollars.

Can I have both a pension and an annuity?

Yes, combining both can provide more security and flexibility in retirement.

You may also read: Cryptography Algorithms Read Online – Free PDF Books & Resources